When and also How Beneficiaries Get the Money Coming to Them

A life insurance policy is a very usual thing that figures into lots of people’s durable financial planning. Acquiring a life insurance plan is a means to get your loved ones, offering them along with the venture capital they may require after you perish. For instance, you might acquire a life insurance policy to help your spouse cover home mortgage remittances, even daily costs, or even the amount of money your youngsters’s college education and learning and discovering cost.

When acquiring a life insurance policy, it is actually crucial to comprehend specifically just how it functions and also how your recipients may obtain the revenues from your program. This can aid in selecting a payout alternative that functions best for your property-related objectives.

Life Insurance Policy Basics

Life insurance is actually a form of insurance contract. When you buy a life insurance strategy, you allow yourself to pay costs to keep your defense in one piece. If you perish, the life insurance policy service can easily pay out a survivor benefit to the person or even persons you got in touch with as beneficiaries of the plan.

Some life insurance strategies may utilize both death and living advantages. A residing advantage motorcyclist allows you to utilize your strategy’s life insurance payment while you’re still alive. This type of cyclist can be important in instances where you’re terminally ill and also need funds to spend on treatment.

“Some life insurance firms have actually designed policies that permit their insurance coverage holders to pull against the face value of the policy in the unlikely event of a terminal, chronic, or vital health issue,” pointed out Ted Bernstein, proprietor of Life Cycle Financial Planners LLC. “These plans allow the insurance holder to become the recipient of their very personal life insurance policy.”

Life Insurance Basics

A life insurance policy is a form of insurance contract. When you get a life insurance plan, you take on income costs to keep your insurance coverage undamaged. If you die, the life insurance service can shell out a survivor benefit to the individual or people you named as recipients of the policy.

Some life insurance plans can easily provide each casualty with living advantages. A residing benefit motorcyclist allows you to use your program’s survivor benefit while you’re still alive. This form of bicycling may be valuable in situations where you’re terminally ill and also need to have funds to devote to therapy.

“Some life insurance policy providers have actually made policies that enable their insurance owners to draw versus the stated value of the plan in case of an incurable, severe, or vital disease,” mentioned Ted Bernstein, owner of Life Cycle Financial Planners LLC. “These policies permit the insurance owner to become the recipient of their own life insurance policy.”

When acquiring life insurance, it is actually crucial to take into consideration:

Just how much insurance coverage do you call for?

Whether a conditional life or even an irreparable lifestyle program creates more feelings

What you’ll devote to costs

Which motorcyclists, if any kind of sort, do you want to consist of?

The differences between life insurance quotes for each and every would-be program

In regards to insurance protection amounts, a life insurance policy personal digital assistant may be useful in picking a death benefit. Condition life insurance covers you for a well-known phrase, while a lasting life insurance policy covers you entirely, just as long as fees are actually paid out. In between each, everyday life tends to become less costly, yet a permanent life insurance policy can easily use perks like money-worth build-up.

Life insurance premium costs may depend on the kind of policy, the amount of the survivor benefit, the riders you feature, and your basic health. It is certainly not uncommon to have to complete a paramedical exam as part of the underwriting process.

What does life insurance cover?

Depending on the life insurance policy you purchase, the death benefit can easily cover lots of costs. After a companion or even spouse, or mom and dad dies, so do their annual profits, so a life insurance policy plan can help fill in the gaps to pay financial devotions such as rental costs or even home mortgage rates, funeral service and funeral expenses, institution tuition, individual economic personal debt, including student lenders or even credit cards, and also nutritional supplement the dropped revenues to aid in paying for everyday costs.

Obviously, many individuals who acquire a life insurance policy safeguard their beneficiaries against financial difficulty.

It is viable to acquire an insurance policy to leave behind an inheritance to your grown-up kids or even grandchildren, a relationship participant, or even a not-for-profit. Some policies, like entire or global life insurance, permit you to access your life insurance policy funds while you reside. You might have the capacity to acquire versus your policy just as long as you remain to pay prices to spend for a home or even college for your youngsters. While you are in danger of lessening the life insurance payment if you cannot purchase it to repay the financing, these life insurance policy plans can be valuable.

The plan on its own usually covers natural and unintentional causes as well as murder. In most cases, it covers self-destruction, although it is a good concept to look into the planning you want to acquire. There may be actually disorders fastened that have to be satisfied before receivers acquire their survivor benefit in some conditions.

Phrase: Life Insurance vs. Permanent Life Insurance

A phrase life insurance policy gives defense for a set amount of your time, normally in 15-, 20-, or even 30-year policies, although timetables may differ depending upon the insurance company. Term life’s survivor benefit is not paid after the relationship to the life insurance policy ends, regardless of whether all premiums on it have actually been made. Nevertheless, expenses on conditional lifestyle plans are normally affordable compared to irreversible life insurance policies.

Term lifestyle could be valuable if you prefer coverage during the course of your prime operating years or even while your young person or children are young to give some financial defense to your companion, husband, wife, or even children. A phrase life insurance policy carries out does not possess a cash fund worth, and you cannot acquire cash money versus your survivor benefit. Some term life insurance policy plans can be exchanged for whole or universal lifestyle plans or prolonged; nevertheless, the costs will definitely be considerably higher than the authentic expense.

There are two sorts of long-term life insurance policies: whole-life and universal. All permanent life insurance blends a death benefit with a cash-worth account. An irreversible life insurance policy allows the guaranteed to acquire versus your life insurance plan. If you don’t spend it back, your receivers will get a much smaller repayment. Some plans return on income, which could be used to spend considerably less on expenses than a life insurance policy.

Both the entire and global life insurance policies cover you up until you pass away, unless you quit paying out the fees; nonetheless, your survivor benefit diminishes as you acquire it.

Only How Much Does Life Insurance Cost?

The price of life insurance depends on a handful of variables, among them the sort of insurance policy you buy, the insurance carrier offering the plan, and sometimes your general personal well-being, health, and family history. As an example, if you pick a 20-year condition lifestyle plan and are a well-balanced grownup, you may pay simply $30 a month for a half-million-dollar death benefit. Phrase life is less costly than an entire or even international life insurance policy, plus all insurance coverage becomes much more costly as you age.

A whole or even worldwide life insurance policy is substantially more costly and could establish you back upwards of $125 to over $200 a month, depending on your age, your well-being, and also the quantity of your life insurance payment.

Choosing a Life Insurance Beneficiary

As part of the method, when purchasing life insurance, you’ll be required to assign numerous named beneficiaries. This means that you intend to acquire the survivor benefit coming from your plan when you pass away. A life insurance policy named beneficiary could be:

A partner

Mom and dad

Sibling

Developed youngster

Provider buddy

Philanthropic institution

rely on

You may decide to contact a singular named beneficiary or even a primary recipient and one or more dependent named beneficiaries. A contingent beneficiary will surely obtain survivor benefit from your life insurance plan if the primary named beneficiary dies.

Filing suit

Survivor benefits are not paid out automatically from a life insurance policy. The recipient ought to begin with a lawsuit with the life insurance policy company. Based on the insurance company’s programs, this may be actually performed online, or it may even need a newspaper declaration. Despite just how you wind up declaring, the provider generally needs records and sustaining proof to process the insurance claim and payout.

Your recipients might be required to deliver a duplicate of the plan along with the situation form. They need to likewise send an accredited duplicate of the fatality certification, either with the area or even city or along with the clinical location or retirement home in which the covered died.

Policies that are revocable or irreversible depend upon the requirement to guarantee that the insurance provider has a duplicate of the leave newspaper identifying the operator as well as the named beneficiary, as featured by Bernstein.

When benefits are paid

Life insurance advantages are normally worthwhile when the insured person dies. Receivers send a fatality insurance coverage case along with the insurance policy company by submitting a certified reproduction of the death certificate. Bunches of conditions permit insurance coverage organizations 30 days to check out the insurance claim, after which they can easily pay it out, reject it, or even ask for included details. If a service quashes your instance, it usually gives a reason why.

Most insurers pay within 30 to 60 days of the time of the insurance claim, according to Chris Huntley, creator of Huntley Wealth & Insurance Services.

“There is no compilation timespan,” he says. “But insurers are actually motivated to pay immediately after obtaining authentic verification of fatality to stay away from higher enthusiasm fees for holding off settlement of claims.”

Payment Delays

There are a number of feasible instances that might cause a hold-up in repayment. Receivers might encounter hold-ups of 6 to 12 months if the covered dies within the first 2 years of the issue of the plan. The element: the one- to two-year contestability clause.

“A lot of programs include this condition, which allows the carrier to check out the original request to guarantee fraudulence was actually certainly not devoted. Just as long as the insurance policy company may not confirm the coverage pushed by the application, the advantage will usually be paid,” mentioned Huntley. A great deal of plans also include a self-destruction clause that enables businesses to debate benefits if the insured passes away through self-destruction throughout the first couple of years of the plan.

Repayments might additionally be held off when homicide is kept in mind on the insured’s casualty certification. Within this instance, a situation representative might communicate with the investigator assigned to the instance to get rid of the recipient as a suspect. The payout is stored until any sort of anxiety involving the recipient’s involvement in the insured’s fatality is crystal clear. If there are expenses, the insurance policy provider can easily keep the payment up until expenses are dropped or the recipient is acquitted of the criminal offense.

Hold-ups to settlements could additionally come up if:

The insured event died throughout the training course of illegal duty, such as steering intoxicated.

The insured occasion lied on the plan application.

The covered activities omitted wellness and wellness complications, dangerous activities, or even activities like skydiving.

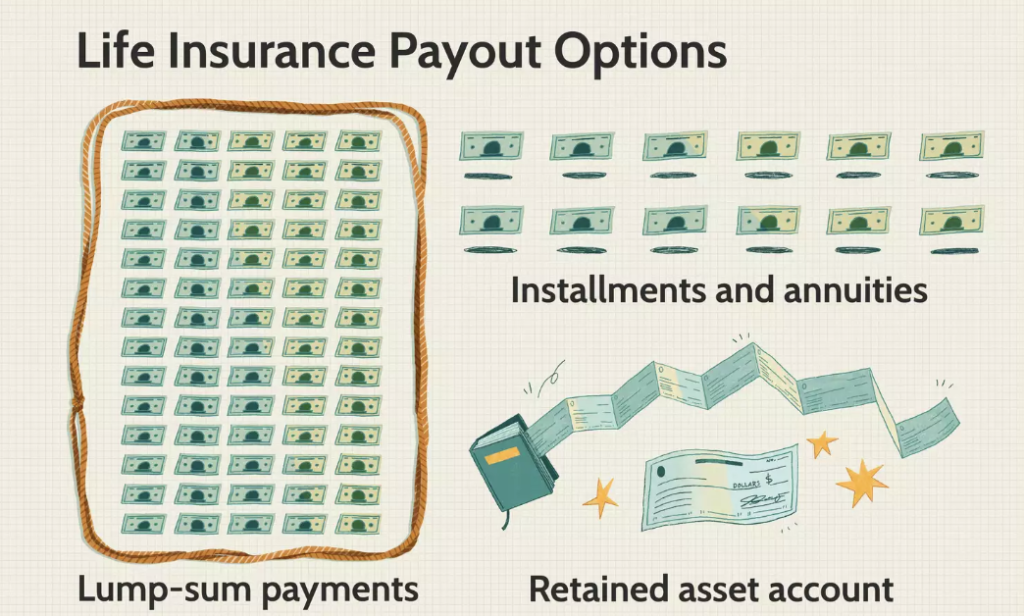

Payment Options

You can additionally help determine how your life insurance payment will definitely be paid after you die. Below are a few of the payment alternatives readily offered to you as well as your recipients.

Lump-Sum Payments

Due to the fact that the marketplace developed more than 200 years ago, receivers have actually typically acquired lump-sum negotiations of the incomes. The default payout selection for lots of plans continues to be a round figure, claimed Richard Reich, president of Intramark Insurance Services, Inc.

. Installations and Annuities.

Modern life insurance plans have observed a significant remodelling in only exactly how remittances may be provided to the plan’s beneficiaries, declared Bernstein. These feature an installment-payout substitute, or even a pension selection, through which the revenues and developed enthusiasm are paid on a regular basis over the lifestyle of the named beneficiary. These choices offer the strategy manager the possibility to choose a pre-determined, assured earnings flow of between 5 and 40 years.

“For income-protection life insurance, the majority of life insurance clients prefer the installation option to guarantee the incomes are going to last for the needed variety of years,” featured Bernstein.

Recipients must remember that any kind of interest rate profit they get undergoes tax. You might end up far better off with the round figure rather than installments, as you’ll wind up spending a lot more on tax obligations if the survivor benefit is actually somewhat high.

Preserved Asset Account.

Some insurance policy suppliers send recipients of substantial policies a checkbook instead of a lump sum or even regular payments. The insurance carrier, serving as a bank or even financial institution, keeps the repayment in a profile, enabling you to compose examinations versus equilibrium. Such a profile would certainly not allow down payments, but it would nonetheless pay interest to the recipient.

The condition for this is an improved survivor benefit. (For a related understanding, take a much more detailed take into consideration sped up advantage bikers.) Commonly, life insurance plans are going to simply settle at the insurance owner’s death. Talk with your insurance protection representative about whether this alternative makes sense for you.

Exactly how does term life insurance work?

Term life insurance is actually commonly among the most attainable kinds of insurance policy protection to obtain. Relying on the kind of policy, you could or even may not call for a medical exam, and the plan will certainly last for an agreed-upon number of years, regularly 20- or 30-year phrases. You pay for month-to-month premiums on your survivor benefit, and if you pass away just before the condition is up, the insurance provider pays your beneficiaries. If you achieve your term regulation, your plan finishes.

Exactly how does whole life insurance work?

Unlike phrases, an entire life insurance policy is a lasting kind of insurance policy protection, making it possible to deal with survivor benefit protection over the insurance holder’s lifestyle. The life insurance policy costs for the whole life insurance policy are more than what you spend on a life insurance policy. Whole life possesses a cash-value regard, which can easily develop as interest gathers at a prepared rate and also in a tax-deferred manner.

You may borrow versus your whole lifestyle plan; nonetheless, the perk acts as security, so your benefit decreases if you do not pay it back. If you certainly do not pay for the costs or even the finance back, your strategy will undoubtedly be terminated. Any kind of loan you acquire could be based on profits and also on tax obligations.

Only How does universal life insurance work?

Universal life insurance, like an entire lifestyle, is actually another type of permanent life insurance policy. These strategies provide a survivor benefit as well as a cash loan market value profile. A universal life insurance policy sticks with you until fulfillment if you pay your month-to-month expenses. There are three types of common life insurance policies: adjustable, guaranteed, and recorded; nevertheless, with all three, you have the flexibility (unlike a variety of other plans) to alter your survivor benefit or lower your premiums. Your cash value profile’s incomes can help pay the fees on your profile.

Can You Get Life Insurance With a Pre-Existing Condition?

If you have pre-existing disorders, you may find it difficult, yet not impossible, to buy life insurance. Coverage is going to depend on various factors, largely your specific wellness situation. Relying on the life insurance company, some pre-existing concerns like diabetes mellitus, high blood pressure, and anxiety could be dealt with, but with greater costs.

How much time do you have to pay into a life insurance policy before it pays out?

Life insurance will certainly pay upon the fatality of the insured as promptly as it holds. This commonly awaits the first cost of remittance. Some life applications, nonetheless, featured the choice of binding a certain amount of insurance policy coverage while the underwriting treatment takes place in the event that the candidate dies prior to the policy being launched (described as a binder). The binder generally requires remittance up-front when the application is taken and will also definitely either be sent back or associated with the very first expenses when authorized.

All-time Low Line.

Life insurance policies deal with both policyholders and their loved ones satisfaction that economic complications may be protected against in the event of an individual’s casualty. Understanding specifically how the method functions, from getting a life insurance policy to suing to acquiring a payout, can help you proceed with your plans to acquire protection with assurance.