When it comes to acquiring a life insurance policy, additional coverage is usually far better.

Typically, you need life insurance if various other individuals rely on your profit or if you have debt that is going to continue after your death. Nonetheless, the older you are, the more expensive your life insurance policy ends up being. That’s why the more youthful you are when you acquire a life insurance policy, the better normally, specifically if you can safeguard a low cost. If you hang around too long to acquire life insurance, certainly not merely because it is far more expensive, it may be harder to acquire the policy taken through an insurance coverage underwriter.

The correct time to acquire life insurance varies from person to person, depending on home and monetary conditions. If you would like to get a long-lasting insurance coverage plan along with a cash value, you need to have adequate opportunity for the cash value profile to develop. If you secure a condition life program, it’s just ready for a particular amount of years and doesn’t feature a loan value part, so the superior time to acquire a policy could be a variety of.

Why Younger Is Actually Usually Better

When it comes to timing, the more youthful you are when you obtain a life insurance policy, the less costly it will certainly be. This is actually because, at a more youthful age, you’ll receive lessened superiors. And also, as you grow older, you could develop health issues that make insurance extra expensive or probably prevent you from obtaining a plan.

Nevertheless, additional vibrant people challenged with mortgages, auto negotiations, and student finance financial responsibility frequently tend to stay clear of acquiring a life insurance policy. While settling current economic obligations is critical, losing a life insurance policy at a young age has a significant economic impact, much like delaying saving for retirement. The faster it is actually obtained, the better.

At times, you might not need to have a life insurance policy, such as if you’re not considering having dependents like kids or a life companion, or to receive a home mortgage, and your estate can be settled with the resources you have at the moment of your death. However, if you think any one of these traits may be in your future, it still may pay to obtain life insurance, even just before you’ve obtained an obvious need for it.

When to Purchase Term Insurance

A life insurance policy covers you with respect to the policy. While a much younger age is generally much better, when that term must start also might be based on when you expect other people to be depending on your earnings. You’ll desire respect for the planning to last, provided that your dependents will require your earnings. For mothers and fathers, this is actually frequently until their young people are actually extended.

Folks in married couples that possess houses along with one another might intend to be dealt with until their home mortgage is actually settled. If both people in a pair are actually making a profit, that is crucial to the family, and afterwards each necessity must be covered. Moms and dads who don’t get revenues may additionally want to consider defense, as their overdue effort (child care, etc.) might demand to be changed through paid services (such as childcare) in the event of their deaths.

Life insurance may be prudent even before you have dependents if you have unguarded financial debt, like bank card balances or some private student lending. For instance, credit card organizations demand that all exceptional balances be compensated upon the death of the proprietor.

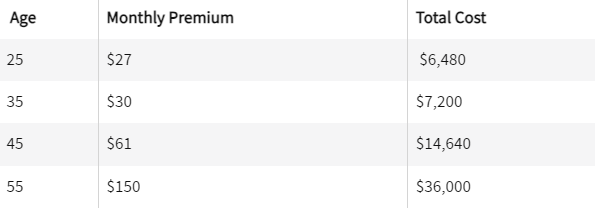

The table listed below shows examples of month-to-month and overall cost expenditures for a 20-year-term lifestyle plan gotten by a well-balanced, non-smoking guy as he grows older. Along with growing older, life insurance rates differ depending on where you live, gender, existing wellness problems, and possibly other market aspects.

20-Year Term Premiums for $500,000 Policy for a Healthy Male Non-Smoker

When to Buy Permanent Life Insurance

Along with a permanent life insurance plan, the cash amount of the money grows tax-deferred. Price contributions to whole-life plans gotten at an early age can easily gather notable value over the long term, as premiums are typically corrected for the whole life of the plan.

Cash value may also be actually used as a deposit for an extremely first home acquisition. If held long enough, what you accumulate might possess the capacity to enhance retirement income. Nonetheless, the money calls for opportunity to develop, which is actually why an early start is ideal.

Expense of Waiting

Surrendering life insurance purchases at a young age may be expensive. Because long-term life insurance policies intend to grow in market value gradually, the quicker you buy in, the better off you will definitely remain in the future.

Conditional plans are actually different because each person is different when it comes to making a decision, and that regard to protection is very useful. Still, purchasing an extra-vibrant age helps keep the expenditure minimized. As an example, the typical expense of a 20-year degree term program along with a $250,000 skin quantity concerns $205 annually for a well-balanced 25-year-old male. On the other hand, the annual price for a 45-year-old man is $421.

In addition, standing by to acquire a life insurance policy can have a greater impact on an effort to buy a plan. Medical problems are actually more probable to arise as a person grows older. If a notable clinical health condition arises, a plan may be “rated” by the lifestyle underwriter, which may cause greater fee payments or even the opportunity that the application for protection may be decreased outright.

When is actually the absolute most reliable time to get life insurance?

The more youthful and healthier you are, the lower the cost of a life insurance plan will absolutely be. If you are considering starting a family, it is normally a good idea to acquire life insurance back then, or perhaps a couple of years just before that, to make an additional budget helpful in the future. When you’re all set to obtain, our checklist of the absolute most efficient life insurance company can easily help you make the best option for you.

What life insurance should I get when I have a baby?

If you have children, a life insurance policy can provide the required financial support in the event of an unlucky casualty. In relation to quantity, the survivor benefit needs to be enough to deal with all your existing financial debts as well as obligations, change your profits for the years that your kids will surely still rely upon you, and also have the ability to likewise pay for points like college learning and understanding.

When should I buy term life insurance?

Term life insurance may be a great additional inexpensive alternative when you only require the life insurance payment for a very small number of years and until your whole life, right into old age. If you possess financial obligations or dependents, or are actually simply thinking of them, it might be a great time to get term life insurance. Talk along with an insurance agent or broker to help you choose what is actually best.

When Should I Buy Life Insurance for My Child?

Life insurance policies could be jumped on children straight after they are born. An irreversible life insurance policy plan for a kid will undoubtedly feature a far reduced premium than when that individual is a grown-up. At age 18, you may then transfer the insurance over to the child so they will certainly have protection.

Should I buy life insurance when I am young and single?

It depends on whether you assume you will definitely begin a family down the road. If so, it is actually really good to buy insurance policy protection when you are even younger, when it is actually a lot more budget-friendly. You might also want a life insurance policy to build a real estate deal, donate to charity, or even work out economic responsibilities as well as responsibilities for your casualty, whether you’re single or otherwise.

All-time Low Line

The longer you wait to obtain a life insurance policy, the more expensive it will be. Also consider that if you stand by, you run the risk of deteriorating health and well-being, which may rear your costs likewise in addition or make you ineligible for some life insurance after that. When you need to get a life insurance policy, it is going to definitely depend on your personal and family circumstances, in addition to your financial resources and obligations. However, normally, a life insurance policy is more economical when you are actually young.

If funds are actually tight, a conditional life insurance strategy may provide an economic guard for your house. If you acquire an irreversible life insurance policy, possessing it over the years will undoubtedly offer the cash market value component of the strategy time to broaden.